Automatically Trades and Earns. The use of leverage is much more popular in Forex than in other markets such as stocks or commodities.

What Is Leverage In Forex Forex Leverage Explained

Ad Automatically Copy our Trades.

. Brokerage accounts allow the use of leverage through margin trading or in other words brokers provide the borrowed funds to traders to increase trading positions. Expressed as a percentage this is a number from your broker that will tell you how much capital you can control based on what you put in. Many professional traders also recommend this leverage ratio.

Leverage in forex trading is a risky business so you need a broker that can offer a range of possible leverages and will have your best interests. Imagine the scenario where youre buying shares with a view to becoming a professional share dealer. So if your trading balance is 100 you can trade 10000 100100.

So to recap what is leverage in Forex. Leverage Trading Meaning in Profit and Loss. The best leverage for 100 forex account is 1100.

With that traders can trade at a notional value much higher than the current capital they actually have. If your leverage is 1100 it means for every 1 your broker gives you 100. Well its the additional amount of capital granted by the Forex broker that allows retail traders to open positions larger than the margin requirement and even account balances.

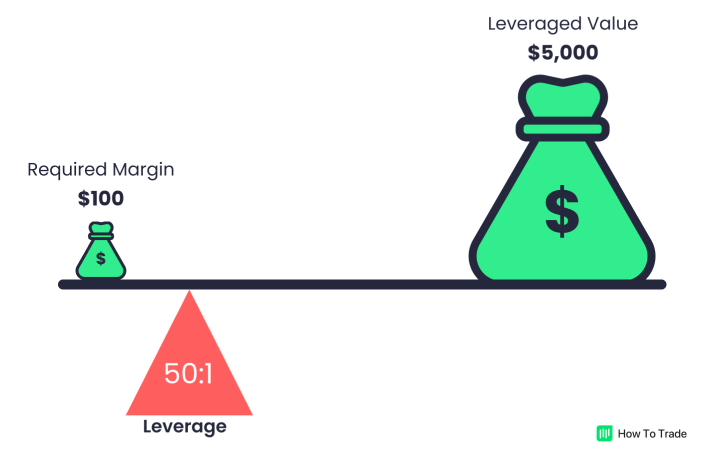

Meanwhile Trader 2 opens a position of 51 leverage meaning their position is worth just 500. The leverage ratio can amplify both profits as well as losses. Essentially traders are borrowing money from their broker in order to increase their buying power when placing trades.

Even though 1500 is really large leverage in Forex some brokers offers leverage high as 12000. We have gone on to become the best one on one forex trading training. The advantage of using leverage is that you can use more money than you have to increase your returns.

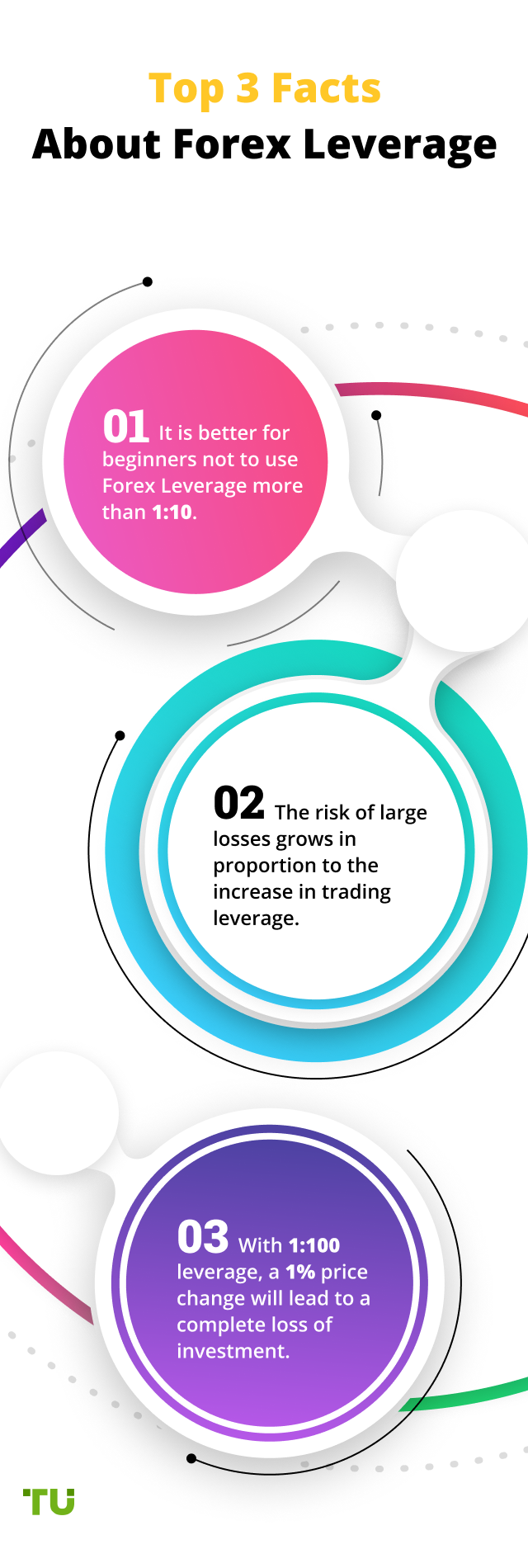

Forex Leverage is the ratio of the traders funds to the size of the brokers credit for example 1100. Usual leverage in Forex that traders like to use is 1100 and up to 1500. What Does Leverage Mean in Forex.

Once a leveraged trading position is closed the money borrowed is returned to the broker and. Leverage is the ratio of the amount of money needed in a transaction to the required deposit. The leverage ratio in the foreign exchange markets is commonly as high as 1100.

Leverage is the force in trading that enables traders to take exposure to artificially amplified transaction sizes in order to make more money from each individual transaction. Leverage 1100 means that for every 1 in the trading account traders can trade in the market up to 100 in value and the required margin is 1. Note that its not a requirement to use the leverage provided by the broker.

There are three basic trade sizes in forex. Leverage In Forex Trading How It Works. High leverage in Forex means borrowing the money from a broker that is larger than 110 or 120.

Using high leverage in Forex does not mean having more chances to make money. Forex and CFD leverage allows both retail and professional traders to access larger position sizes with a smaller initial deposit. This expresses the relationship between the capital you put up versus the position you control.

This refers to the capital you put in. They decide to use the 501 leverage which means that they can trade up to 500000. Wide Range Of Investment Choices Including Options Futures and Forex.

A Leverage is a type of loan that traders take from broker companies to maximize their profiting potential. Leverage is the ability to use something small to control something big. Forex leverage explained.

The lowers the margin requirement the more significant leverage can be used on each trade. Ad Learn the Fundamentals of Online Forex Trading. Leverage also referred to as margin trading is a trading instrument used to generate a substantial payout with smaller deposited capital.

Specific to foreign exchange forex or FX trading it means that you can have a small amount of capital in your account controlling a larger amount in the market. In the world of forex this represents five standard lots. In this scenario both traders were incorrect in their predictions and USDCNY dropped 100 pips.

Leverage is borrowed money from the broker to increase trade size.

The Relationship Between Margin And Leverage Babypips Com

What Is Forex Leverage Definition And Use Cases

/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg)

0 Comments